Cross-currency model

Choose your default capital currency. Any of the major currencies can be used to denominate your Paid-up capital.

Start Solo

All you need to get started is one director, one shareholder and US$1 of issued capital. Go solo or with friends, your choice.

0% corporate tax

Zero corporate tax on capital gains, dividends or interest. Zero offshore income tax. Ultimate choice for global-businesses.

Minimum reporting

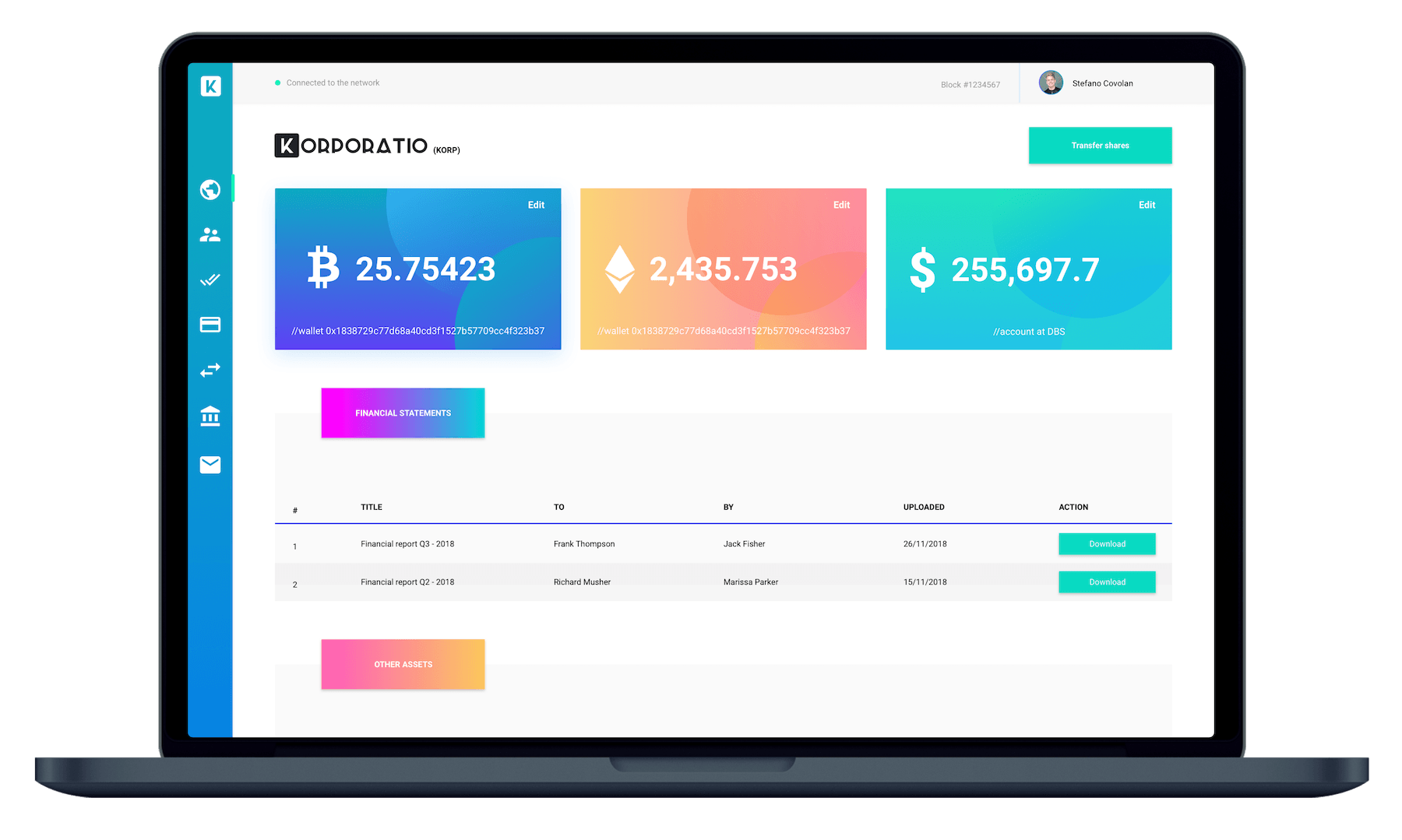

Accounting records are required. Financial statements, annual or tax returns are not. Minimal burden on record-keeping.

How it works?

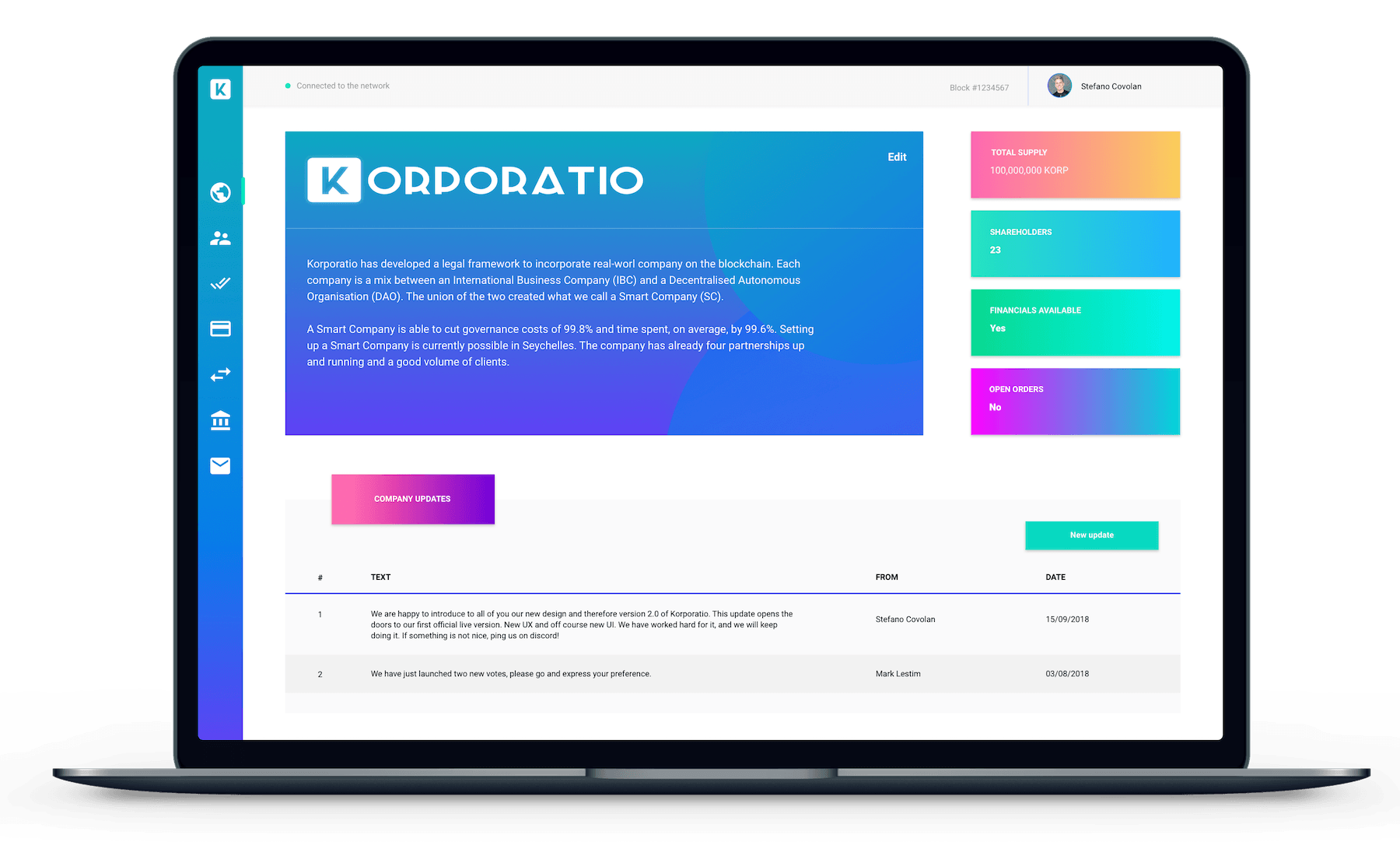

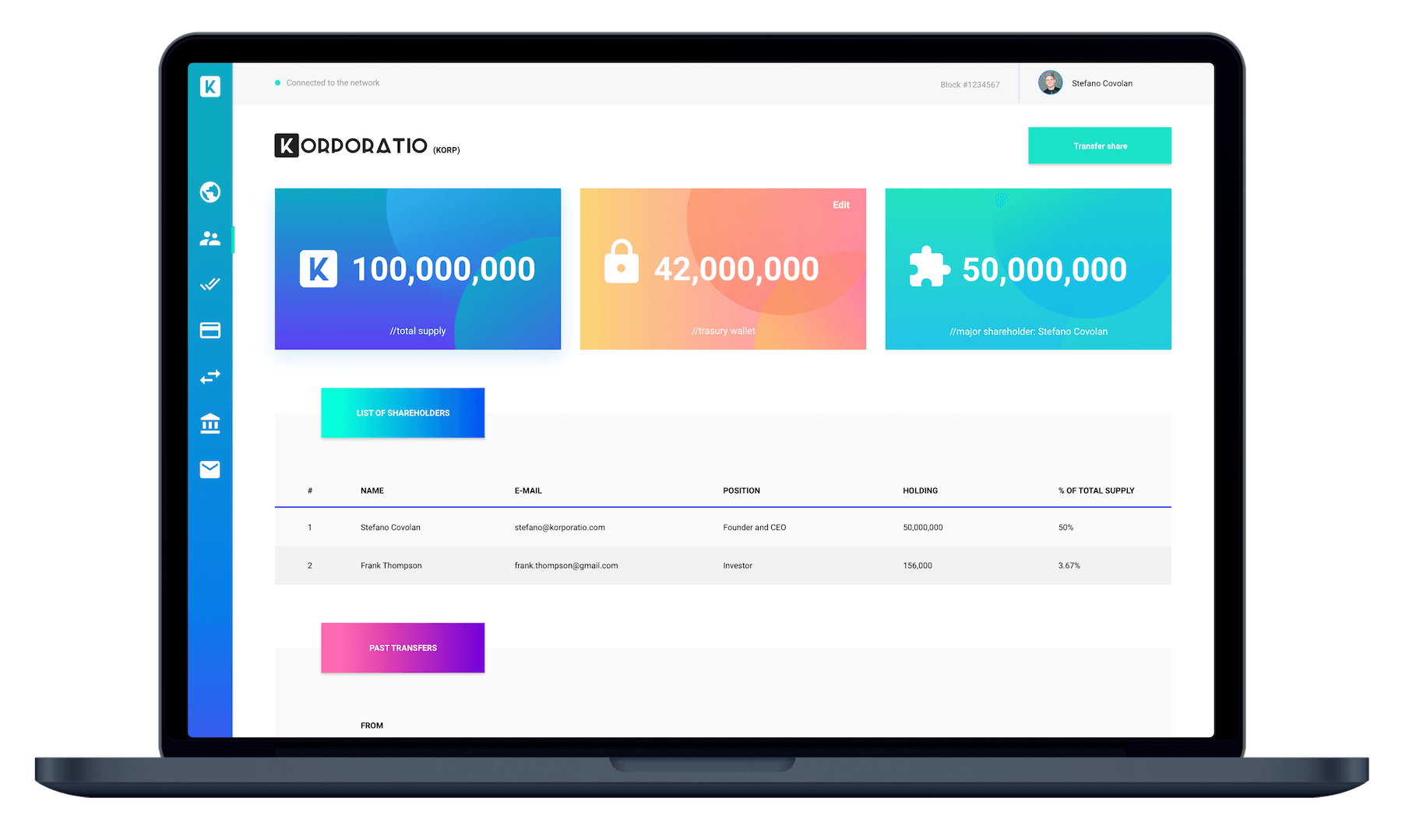

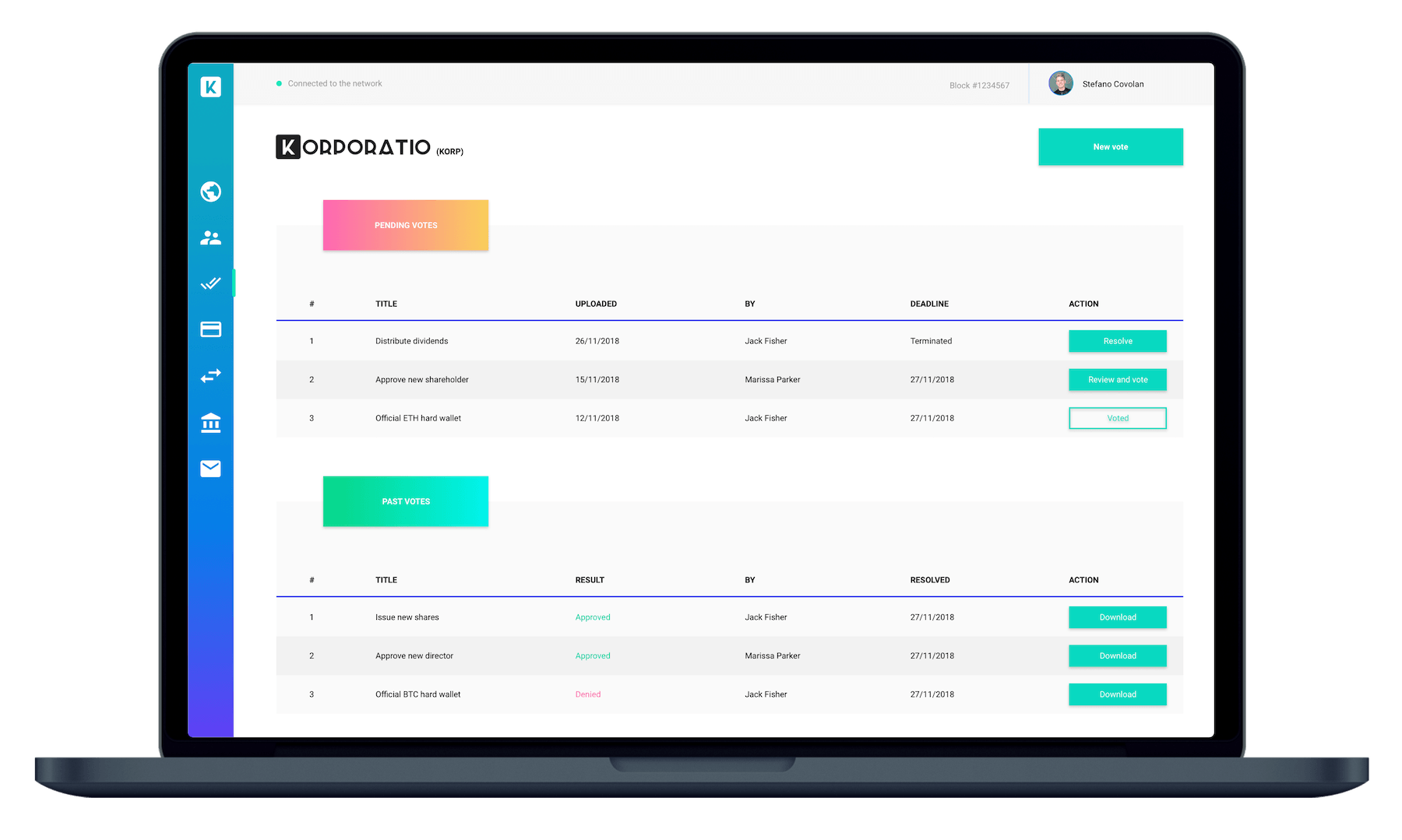

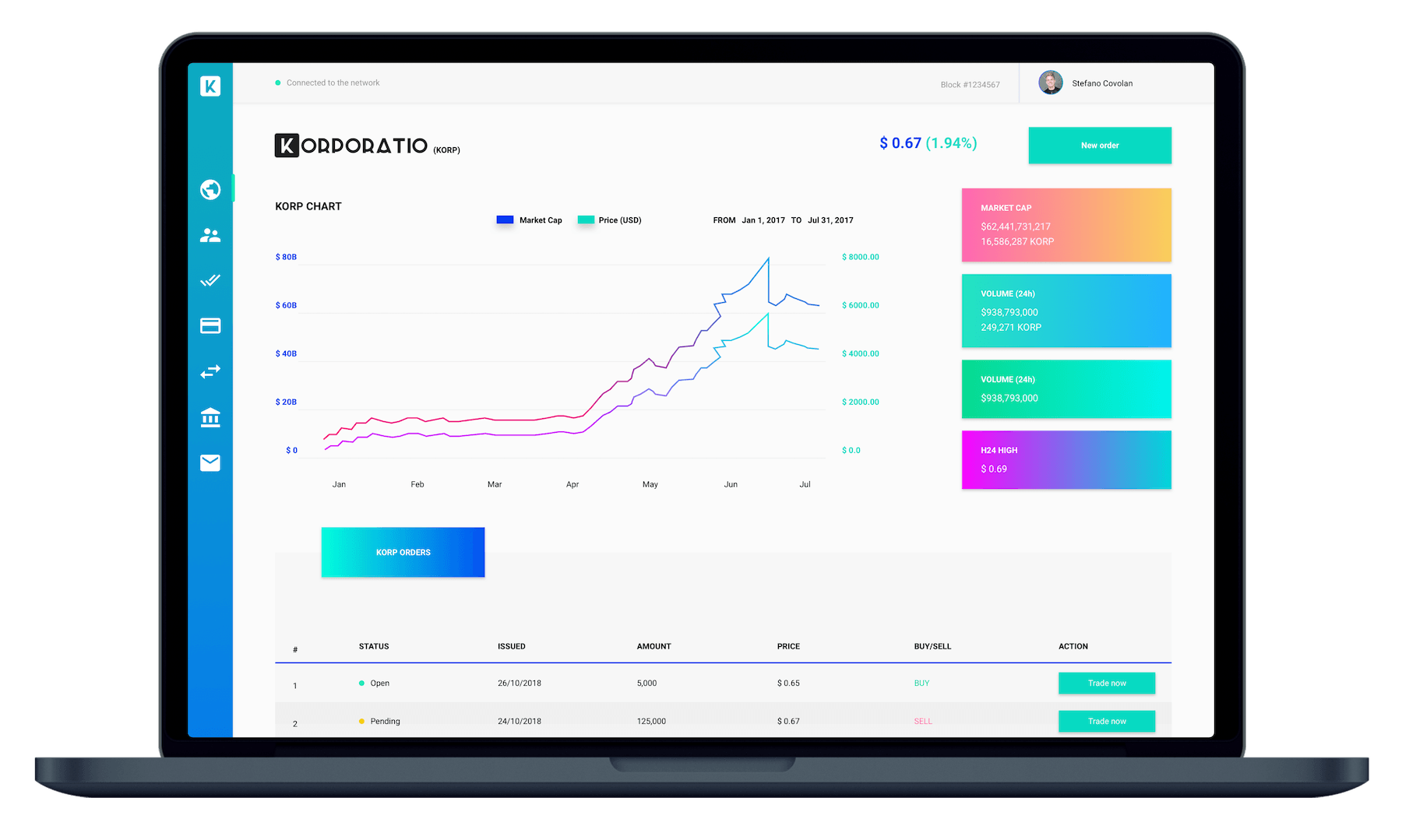

Incorporation is just the 1st step.After you’re set up, your dashboard will have everything you need to manage your company. No physical visits required. One package, all included.

November 26, 2019

Why Choose Seychelles?

Dynamic, cost-effective and versatile. Learn more why set up a company here!

November 26, 2019

Seychelles Smart Company – A Paperless Entity

Paperless and automated. How is Seychelles Smart Company from a traditional company?

September 15, 2019

Smart Companies shave off 75-95% of your time & money

Setting up a company shouldn't take up so much time and money. Learn more!