It’s the last month of 2020. The year of Covid, remote offices, webinars, virtual hangouts and of course, WFH (work from home).

While the global pandemic has hit businesses hard across industries, interestingly, the trend of starting new businesses has increased regardless of all the uncertainty. We’ve witnessed this amongst our own community across all our jurisdictions as well as through external stats. In the U.S alone, the number of new company establishments has continued its growth, increasing from 770K new incorporations in 2019 to 804K by third quarter of 2020. What makes this growth especially interesting is that it happened despite the fact that over 70% of US small businesses had to shut down in March 2020 with uncertain outlooks of their ability to ever reopen and be operational again.

So if I had to choose one word to describe the entrepreneurial spirit of this year, it’d have to be resilience.

And then, things became digital.

So much so that operating 100% digital has become more of an expectation, over an exception.

Paperless management, borderless transactions, multinational founding teams. Work from wherever you want, whenever you want. What used to be a rather niched reality of digital nomads or location-independent entrepreneurs has now become a new normal for many growing companies.

So congrats – you are digital, your market is global and you’re scaling up: but how the heck do you hire remote talent internationally in a smart way?

Disclaimer: We are not lawyers. As much as we’re working in this space and intersect company formation, governance, tech + regulations, always do your own research and make sure to contextualize any gained information to your specific situation.

Contents

Remote-first hiring: what’s the problem here?

In theory, no problem. In reality, ehmm. It can be a bit more complicated than that so bear with me.

If your company is incorporated in country A and you want to hire people from and in country B, you basically have 3 options:

- hire independent contractors;

- set up a legal entity in country B;

- hire via an EOR (Employer of Record)

The general rule is that if you want to hire a full-time employee in another country than your company’s place of incorporation, you need to first set up a legal entity in that other country before you can do that. Your operations will then fall under the country’s local regulations such as employment law and sales tax; note that these will affect your ability to conduct business. If you don’t want to or have the capability to do that, your options are pretty much limited to either hiring independent contractors or through a third party, an EOR.

How to decide between these options comes down to the amount of resources you’re able and willing to dedicate to do this, tax considerations, legal exposure, future projections and so on.

Before we go through all three alternatives, let’s clarify the difference between contractors and employees first.

Contractors vs. employees

The main difference between an employee and a contractor varies depending on the country; this typically linked to the level of control and independence between the employer and worker. For instance, IRS’s general rule for defining an independent contractor is whether the payer has the right to control only the result of the work and not what will be done and how it will be done. Generally speaking, a contractor falls under self-employment tax and the company hiring them does not need to withhold income tax or pay social security, healthcare and unemployment tax.

An employee, on the other hand, is someone whose work is controlled by the payer. Employees’ expenses are typically covered or reimbursed and they work using the tools and equipment provided by the employer.

Option #1: Independent Contractors

This is perhaps the most common way for a company to hire international workforce. It’s certainly the fastest and most economical way of doing things. You, as the company, sign an agreement with the individual you want to hire, wire them money as mutually agreed and the contractor shall sort out all the local regulatory aspects themselves.

Pros and cons

Many startups do this to scale rapidly, expand and test different markets. It’s the easiest and lightest on red tape of all the three options. You’ll have access to a global talent pool with minimal commitment and can leverage things such as different time zones to provide 24h customer service.

Consider the regulatory maze

The biggest upside of hiring independent contractors is definitely the absence of employment law and regulatory burden. This may sound harsh from a job candidate’s perspective but considering each country has its own unique and complex employment laws where holidays, maternity leaves, termination and wage policies vary widely, it can be a lot to ask from a resource-constrained startup that is just starting to expand internationally.

For instance, in some countries emailing teams outside of office hours is legally considered harassment. Years ago, Volkswagen stopped its servers from sending emails to employees off-shift and following that, Daimler went even further and set up a software that automatically deleted all emails sent to out-of-office employees; not just storing them in somewhere else but actually, deleted them.

The intention behind such policy is, as a responsible employer, to give employees the right to disconnect. While in some cultures this may receive applauds, in others it might seem absurd. So again, if you’re a rapidly growing startup that has teams sitting across different time zones, what may be an email sent during one employee’s office hours might be another employee’s offline hours. You get the point. As a founder, you want to make sure there’s enough resources and capability to be dealing with these types of regulatory aspects and social nuances if you want to hire employees over contractors.

Consider team commitment

Now, hiring contractors might be the legally lightest option but it also has its downsides. While your access to the talent pool might be wider, it’s also fair to ask yourself as a company, how much commitment are you expecting from independent contractors? Not being able to include them into employee stock options, company benefits, healthcare and such packages might understandably be considered less desirable from job candidates’ perspective. And expecting exclusivity from them is difficult, legally impossible.

Oh yes, and then there’s this:

“Is it a problem if I misclassify my worker as a foreign independent contractor/employee?”

In short: yes, it is a problem. Mostly, the legal exposure here is if an actual employee is being “masked” as a contractor as definitions of the two vary widely country to country. The consequences and penalty vary as well but to give you an idea, if the US Labor Department or IRS finds violations, they will investigate all of the company’s employees and contractors for a 3-year period. Penalties vary from fines to imprisonment.

Each country has different definitions for what is an independent contractor. In some countries, a worker who signs a non-compete or non-solicitation agreement is an employee because these are considered as evidence of the employer’s control over the worker after termination; in Spain, if a contractor devotes more than ¾ of their time to a company, they are entitled to benefits such as 18 days annual paid leave and severance pay.

We won’t go too much into the details of this but make sure to do your homework. Here’s a well-written lawyer firm perspective on hiring international contractors.

Option #2: Setting up a local legal entity

Out of the three options discussed in this article, this requires most commitment as an employer. So to answer the classic question; “do you need to set up a legal entity each time you hire a new talent from a foreign country?”

Of course not.

After all, it commits you to a new regulatory environment from employment law to local taxing; therefore such a decision should support your mid-term goals and company direction. It can be time-consuming and expensive too.

In the words of Mitchell Hashimoto, CEO of HashiCorp (~250 people, remote first):

“Beyond just paperwork, there are often requirements to establish a legal entity: a real, physical, local address is one. In one country, we had to pay out of a local bank account in local currency (which has its own red tape), and this country also required we maintain a minimum balance to pay 3 months salary in the local account in local currency at all times. For a startup, that much cash “not working” can be problematic depending what stage you’re at.

In one country we’re establishing an entity in, the process just takes a LONG time. We’ve been responding to any inquiries and sending paperwork immediately and we’re 8 months in and still probably 2 months away from completing the process. Meanwhile, we still can’t legally hire there.”

Welcome to our world – this is literally the space we’re trying to disrupt with much, much faster results and automated processes. However, we aren’t live in every jurisdiction out there (yet) so we can very much relate to the frustration Mitchell is experiencing here. While entity setups do require a bit of digging into, it doesn’t have to be a nightmare, trust us.

But if you are planning to expand

What’s more important while considering this is whether this country supports where you’re trying to get to with your business. If this is part of your market expansion plan; if a sizable portion of business is coming from there or key relevant talent resides in this country, it can be a no-brainer to set up a new entity to support the growth.

While it won’t be the most scalable option for rapid international expansion, it is the most established, commitment-driven and compliant option for diving deeper into a new country. You could also consider it as a strategic move; setting up multiple bases across regions with the ability to conduct business; build partnerships, hire talent and tap into regional economic regions such as the EU.

Option #3: EORs

Employer of Record or EOR is a third party provider that helps companies to employ legal, full-time workers in a different country, state or province. If hiring independent contractors isn’t your game and setting up an entity isn’t timely right now, hiring through a EOR might be your best option – or in most countries, the only option.

EOR’s main function is to serve as a legal entity where you don’t have one. Think of it like a compliant vehicle through which you can do your hiring in a legal way. Some EORs also cover payroll and HR functions but not all, these are mainly in the hands of PEOs (Professional Employment Organizations). There is a difference.

In this case, who is your employee really working for then?

Legally speaking, your employee is working for the EOR in their local region; but in every meaningful sense, they’d be working for you. Also, while most EORs will cover some regulatory risk for you, each provider is different and so is the coverage. So do make sure to read the fine prints!

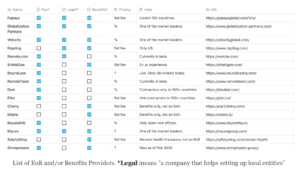

Here’s a useful list comparing EORs compiled by Rodolphe Dutel, Buffer’s ($8M payroll/year, +15 countries) former Director of Operations and Finance:

Hybrid versions

Especially keeping our community in mind, we’re talking about a good number of born-global businesses that operate in an all-remote and decentralized way.

You might have your company incorporated in Singapore, while your nationality is German yet you reside in Hong Kong and your co-founding team is split between San Francisco and Hyberabad. Your product is digital, the market is global and key decisions (by your founding team) are made across continents – how do you hire international talent?

In this post, we discussed 3 options but obviously, there are many more hybrid versions that can be built from these. Companies such as Github (all-remote, 1300 team members across +65 countries) are a great source of reference as they do exactly this.

They hire team members through a combination of the following:

- Contractors through PEO/EOR

- Employees with PEO/EOR

- Gitlab entity

If you want to learn more, here’s a list of Github’s registered entities per country, agreement types and all the EOR/PEOs they use. Super useful if you’re new to this!

Things worth considering

Every company’s situation, stage, ambition and risk appetite is different so make sure to weigh in your priorities.

If you are not sure which direction to move towards to, start by considering a few basic questions:

- Do you own a legal entity in the country where the employee lives?

- How many employees are you planning to hire from that country/region?

- Which countries are you considering?

- How fast are you growing internationally i.e. how scalable do you need this to be?

- What’s your timeframe/deadline to hire internationally?

- How much are you willing to spend on international expansion?

- What’s your risk appetite for compliance? (outsourcing, legal exposure, misclassification of contractor, employment law etc.)

- EOR: Are they global and do they cover the countries and functions you need help with?

- EOR: do their agreements protect your commercial interests e.g. IP etc?

- EOR: is EOR their side line or core service?

- EOR: how easy it is to leave if things aren’t working out?

Have thoughts or questions? That’s what we’re here for. Ask us anything at future@korporatio.com or come say hello to our community on discord!

Related Posts

Korporatio – first mover in Wyoming enabling real-world companies

Find out what our newest jurisdiction in Wyoming means to businesses.

0 Comments10 Minutes

Why tokenize real estate when you can tokenize entire companies?

Common misconceptions and the latest updates of tokenizing assets.

0 Comments12 Minutes

I am a Nomadic Entrepreneur – Where Should I Set Up a Company?

Nomadic founders, global citizens and permanent travellers. Where to best set up your company?

0 Comments20 Minutes

Spread the word around