Initial coin offerings (ICOs), or token generation events (TGEs), are a recent phenomenon which is changing the way investors and entrepreneurs interact in the blockchain space and beyond. Through ICOs, start-ups can raise capital by issuing crypto tokens on a blockchain, most commonly Ethereum, and sell them to, or use them to pay, investors and other stakeholders.

After Bitcoin was invented in 2009, people started to think about cryptocurrencies as fungible and tradable replacement of fiat money, i.e. as a means of exchange. Later, when the price of Bitcoin and of other cryptocurrencies started to rocket beyond most people’s expectations, cryptocurrencies went on to be looked at as an investment, a store of value, or a way to hedge the risks of holding legal tender. After Ethereum and other projects started creating and deploying smart contracts, i.e. software that self-executes in presence of certain conditions, the boundaries between the crypto and real worlds became blurred. Then came the first attempts to create tokens linked to real assets, pegged to other products or services or even to legal tender.

2017 was seminal in many respects. The market capitalisation of the crypto world went into the hundreds of billion dollars. But more important, crypto-tokens started affecting People’s lives. Not just some computer geeks, but also housewives in Japan, teenagers in Korea and hedge fund managers in the U.S. The authorities had to step in and assert their, well… “authority”, in some way ????

So Central Banks, Security and Exchange Agencies and politicians, started to pay attention and look at the tools already in their possession. The first obvious candidate was the hammer.

Securities and investment legislation in various jurisdictions around the world was historically adopted at times when limited availability of information on crucial details about stocks, bonds and other securities or investment allowed unscrupulous, dishonest individuals and companies (or plain-vanilla con artists) to take advantage of the lack of information and lack of safeguards on the marketplace, normally at the expenses of small, unsuspecting or even gullible investors.

Last year several agencies of countries, where the crypto movement was slowly getting out of hand, started using the tools already available to rein in a new phenomenon. Authorities in the U.S., China, Korea and others started banning ICOs, security tokens and other such things, often without providing clear guidance. Rather, just disallowing and prohibiting what was spontaneously happening on the market.

As the legal boundaries have been tested, of course several projects are now looking for their way out of the legal maze, in order to achieve solutions to problems, but in a compliant way.

One of these projects is Korporatio.

But let’s go back to some definitions first.

Equity Tokens

Equity tokens are a sub-category of security tokens that represent ownership of an asset, such as company stock. By employing blockchain technology, a startup could forgo a traditional initial public offering (IPO) and instead issue shares and voting rights over the blockchain.

Observers of the crypto space believe equity tokens will eventually become the predominant type of ICO token. However, agencies such as the U.S. Securities and Exchange Commission (SEC) have indicated that equity tokens are subject to securities regulations, and of course very few startups are equipped with the resources to issue equity tokens that comply with all applicable regulations in all the jurisdictions where they intend to trade (even traditional IPOs are strictly limited to certain jurisdictions). Hence, most ICO promoters in the second part of last year spared no effort in trying to make clear their token was not a security token, or worse, an equity token, falling under the purview of the SEC & allied agencies.

Utility Tokens

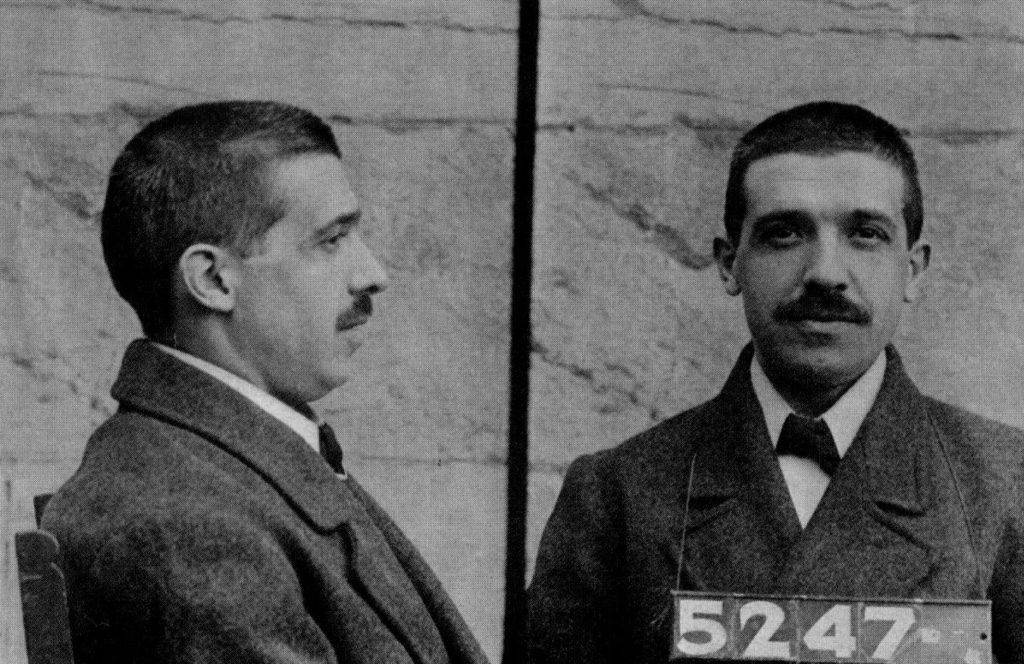

Utility tokens, often called app coins, provide users with future access to a product or service. Through utility token ICOs, start-ups raise capital to fund the development of their blockchain projects, and users can purchase future access to that service, sometimes at a discount. So if you, like me, are allergic to legalese, you would probably ask yourself, all right, how is that different from betting that the company will actually execute well and pull off a finished product or service, as opposed to just sitting back, light up a cigar, give a laugh and get busy with the fat life, like the gentleman in the picture below? Well I am still scratching the head myself ????

Don’t get me wrong, there are projects which are clearly utility tokens. Take the Basic Attention Token (BAT). BAT token functions as a medium of exchange between users, advertisers, and publishers who participate in the Brave browser ecosystem. Advertisers purchase ads using BAT tokens, which are then distributed among both publishers and browser users as compensation for hosting the ads and viewing them, respectively.

Utility tokens are not designed as investment; however, many people purchase utility tokens at ICOs with the hope that the value of the tokens will increase as demand for the company’s product or service increases. Utility token price fluctuations can be compared to event tickets. Many investors, however, buy in not because they are interested in the event, but rather because they hope to re-sell the token at a profit, often before the event even took place. So how is that different from investing or speculating? I am still contemplating the picture above…

To cut to the chase, both equity and utility token prices may fluctuate wildly, the key difference is that equity tokens entitle the holder to ownership rights, while utility tokens function as supermarket coupons and do not provide holders with an ownership stake in a company’s platform or other asset. Both tokens though, are often purchased with an investment or speculative intent, irrespective of the learned legal disclaimers put everywhere on these ICO web sites.

Korporatio decided to deal with this legal uncertainty in another way. We found a jurisdiction which would allow us to incorporate a company whose share register is kept on the Ethereum blockchain. The shares are then tagged with a unique Ethereum token (ERC-20) that is unique to the incorporated company. We call such a company a Smart Company (“SC”).

Because the SC has a legal personality, it can own assets, capital and employ people. Furthermore, there is no difference between the shares in a SC and the shares in the legal entity save that the shares in a SC is connected to the smart contract. The tagging, done by the ERC-20 tagging does not alter the legal validity of these shares – these are still ordinary shares in law, and are real, practical and are verifiable. The changes you make to the shareholding of your company through the blockchain do not require any further endorsement, replication or action by a company secretary or other officer.

We just enable you to create a company, a REAL company, on the blockchain, and you do what you want with it. Create your dream business, become a digital nomad and travel the world, sell the shares to your grandma… up to you. But hey, better you know everything is recorded in a tamper-proof, un-deletable way on the Ethereum blockchain. So we hope you will use this new tool to create and run better businesses, with greater transparency, with better corporate governance and shareholder information.

Welcome to Korporatio!

Related Posts

Future of Corporate Governance Through Blockchain

Regulated and blockchain-powered Smart Companies are paving the way for future corporate governance.

0 Comments13 Minutes

Corporate Governance Professionals – Smart Companies Solve Your Problems Too

Corporate governance is changing - learn how Smart Companies can help!

0 Comments16 Minutes

Korporatio’s New Offer: Mitigating Risk in Decentralized Finance (DeFi)

Regulatory risk is one of the biggest threats in DeFi. Learn how our newest offer may provide a solution!

0 Comments26 Minutes

Spread the word around